by – L. Richardson

America, it’s time to wake up to the Federal Reserve’s inflation scam that’s robbing you blind. While politicians and pundits point fingers at presidents and corporations, they distract you from the truth. Only the Federal Reserve creates inflation by printing money – it’s not rocket science, it’s economics 101. The elites don’t want you to know this simple fact: It’s the Fed, stupid! The urgency of this issue cannot be overstated.

The time has come to expose the Fed’s dirty secret and reclaim control of our economy. This article will unmask the lies they’ve been feeding us about inflation. We’ll explain how the Fed’s money printing machine is the real culprit behind rising prices, not the scapegoats they trot out to fool you. By the end, you’ll understand why blaming anyone but the Fed for inflation is a distraction from the truth that’s bankrupting America. It’s time to fight back against the Fed’s monetary manipulation and demand accountability for the destruction of our dollar. We have the power to reclaim control, and it’s time we exercise it.

Inflation Redefined: How They’re Deceiving You

Historical definition of inflation as money creation, not rising prices.

The truth is out, America! Inflation has long been defined as an increase in the money supply, not rising prices. This historical definition has been used for centuries, exposing the Fed’s lies. The quantity theory of money, formulated in 1517 by Nicolaus Copernicus, argues that inflation is determined by the money supply. An increase in the amount of money in circulation directly causes a proportional increase in the price of goods and services over time. Understanding this fundamental concept is crucial in our fight against the Fed’s deception.

How did the establishment, including the Federal Reserve and other central banks, redefine inflation to confuse the public?

The establishment has worked tirelessly to redefine inflation as simply rising prices to confuse the public and cover up the real cause – money creation by central banks 1. This deception allows the Fed to hide its role in destroying the dollar’s purchasing power. The Federal Reserve’s data shows that the money supply has grown exponentially in recent years. At the same time, the official CPI measure of inflation has remained relatively low 1. This discrepancy proves that the establishment is redefining inflation to hide the real culprit – excessive money printing by the Fed.

Evidence from 20th-century dictionaries and the Fed’s own data.

Dictionaries from the 20th century consistently define inflation as an increase in the money supply, not rising prices 1. This was the universally accepted definition until recent decades when the Fed began its campaign of deception. The Federal Reserve’s own data exposes their lies, showing a massive increase in the money supply. At the same time, official inflation measures remain low 1. It’s time to wake up, America! The Fed is the sole creator of inflation, and they’re robbing you blind while blaming everyone else. Don’t be fooled by their lies – it’s the Fed, stupid!

Blame Shifting: The Scapegoats Used to Distract You

The elites are playing a dangerous game, America! They’re trying to fool you with a parade of scapegoats for inflation. But don’t be deceived – it’s the Fed, and only the Fed, that’s robbing you blind.

Energy policies and ‘supply shocks’-unexpected events that disrupt the supply of goods—how they’re used to mislead.

The establishment wants you to believe supply chain issues and energy prices are to blame. They point to events like the war in Ukraine, which sent oil prices soaring in early 2022 3. But this is just smoke and mirrors! Without the Fed’s money printing, these factors alone couldn’t drive the sustained, economy-wide price increases we’re seeing.

The fallacy of blaming government spending and corporate greed.

Some politicians claim government spending is the culprit, while others blame corporate greed 3. They’ll tell you that four companies control about 80% of the beef and poultry market, allowing them to keep prices high 3. But this is nonsense! While these factors can influence prices, they are not the primary drivers of inflation. Corporations have always been greedy – competition keeps prices in check, and altruism has not been suddenly discovered.

Presidents, Congress, and corporations can only create inflation with the Fed.

Wake up, America! Presidents have far less control over the economy than you might think. Congress and the White House can’t fix inflation by raising taxes or cutting spending. And corporate ‘greed’ can’t explain why prices keep rising over time. The truth is clear: only the Federal Reserve, with its unchecked power to print money, can create the sustained, generalized price increases that define inflation. It’s time to hold the real culprits accountable!

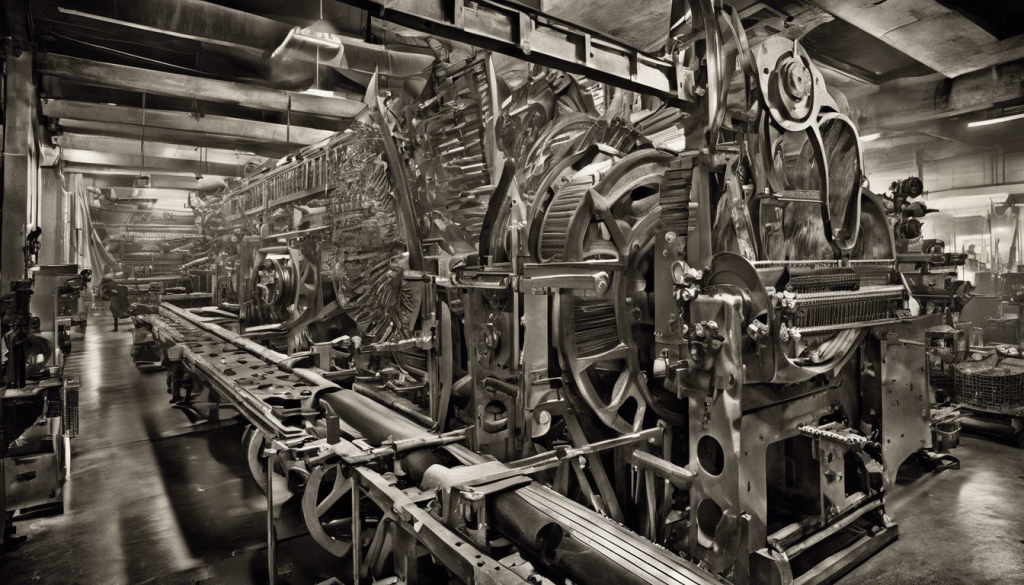

The Real Cause: The Fed’s Money Printing Machine

Wake up, America! The Federal Reserve is robbing you blind with its money-printing machine. This unelected institution can create dollars out of thin air, devaluing your hard-earned savings. The Fed doesn’t need to print physical bills; it credits banks’ accounts with a keystroke 7. This digital money creation is just as inflationary as printing cash.

The Fed’s actions directly affect rising prices across the economy. When it floods the system with new money, borrowing becomes cheaper, encouraging spending and pushing demand 8. This increased demand drives up wages and prices, fueling inflation.

The evidence is evident in the Fed’s own balance sheet. Since 2020, the Fed’s total assets have ballooned from $7.40 trillion to nearly $8.50 trillion by September 2021 9. This massive expansion is the real culprit behind the inflation crisis, not the scapegoats they want you to blame.

Breaking Down the Lies: Common Arguments Debunked

Wake up, America! The Fed’s lies are unraveling. Let’s expose their deception and reclaim our economic freedom.

The impact of oil and gas prices on the economy without new money

The establishment wants you to believe oil prices drive inflation [19]. But that’s a smokescreen! While crude oil impacts the economy, it’s not the root cause. A study showed that a $10 per barrel increase in oil prices only raises inflation by 0.2% 10. Without the Fed’s money printing, these price fluctuations would balance out across sectors.

Why increased prices in one sector must reduce demand in another without new dollars

Here’s the truth they don’t want you to know: In a stable money supply, price increases in one area force decreases elsewhere. It’s basic economics! But the Fed’s endless money creation distorts this natural balance, increasing prices. Don’t be fooled by their scapegoats – it’s the Fed, stupid!

The reality of fractional reserve banking and its dependence on the Fed

Fractional reserve banking is another Fed scam. Banks create money out of thin air, backed by the Fed’s printing press 11. This system expands the money supply, fueling inflation and robbing Americans of wealth. It’s time to demand accountability and expose the Fed’s role in this financial shell game!

Case Studies: The Fed’s Inflation Across History

Wake up, America! The Fed’s inflation scam isn’t new. Let’s expose their lies through history.

Historical examples of inflation linked directly to Fed actions

The Great Inflation of the 1970s was the Fed’s greatest failure. Their policies allowed excessive money growth, chasing a misguided Phillips curve theory 12. By 1979, inflation soared above 11%, with unemployment at 6% 12. The Fed’s actions, not external factors, caused this crisis.

Recent inflation spikes during Covid and government spending—driven by the Fed

In March 2020, the Fed unleashed its money-printing machine. By September 2021, its balance sheet ballooned from $7.40 trillion to $8.50 trillion 13. This massive expansion, not supply chain issues, fueled the inflation crisis. Don’t be fooled by their “transitory” lies!

The Fed’s role in funding massive government programs through new money

The Fed’s unlimited liquidity to banks enabled credit drawdowns and new loans 14. This money creation funded government spending, driving inflation higher. It’s time to hold the Fed accountable for robbing Americans of their wealth!

The Real Impact: How the Fed Robs American Wealth

The erosion of purchasing power and savings due to inflation

Wake up, America! The Fed’s money-printing machine is destroying your wealth. Inflation, the sustained rise in prices over time, erodes your purchasing power 15. As prices climb, your hard-earned dollars buy less and less. The Fed’s reckless policies force you to save more for retirement, as your target amount becomes insufficient 15. This isn’t just an economic issue; it’s a direct attack on your financial future!

The impact on everyday Americans—why you’re paying more and getting less

The Fed’s inflation scam hits hardest on Main Street. Low-income Americans, who spend more on necessities, suffer the most 15. Fixed-income retirees watch helplessly as their Social Security benefits fail to keep pace with rising costs 15 [20]. The Fed’s actions force millions into financial distress, with credit card delinquencies surging to Great Recession levels 16. It’s time to expose the truth: the Fed is robbing you blind!

How the Fed’s actions benefit the elites at the expense of the public

The Federal Reserve serves the wealthy elite, not the American people. Their policies protect the concentrated wealth of the top 1% at the cost of workers’ jobs and families’ financial security 17. While the Fed claims to fight inflation, its true goal is preserving the value of creditors’ wealth 17. The revolving door between the Fed and Wall Street ensures that financial interests always come first 17. It’s time to demand accountability and reclaim control of our economy from these unelected money manipulators!

Call to Action: Reclaim Your Economic Freedom

America, it’s time to wake up and fight back against the Federal Reserve’s inflation scam! The Fed’s unchecked power is bleeding the economy dry, robbing hard-working Americans of their wealth. Since 1913, the American dollar has lost 95% of its purchasing power 18. This isn’t just an economic issue; it’s a national crisis engineered by an unelected, unaccountable institution.

Demand accountability from the Federal Reserve. Under former Chairman Ben Bernanke 18, the Fed’s balance sheet ballooned from USD 500.00 billion to over USD 3.00 trillion. This massive money supply expansion is the real culprit behind inflation, not the scapegoats they want you to blame.

It’s time to take back control of our economy! The Fed’s actions benefit the wealthy elite at the expense of the public 17. Don’t let the establishment silence this message. Stand up, America, and reclaim your economic freedom from the Federal Reserve’s manipulation!

Conclusion: America’s Fight Against the Fed’s Lies

The Federal Reserve’s role as the sole creator of inflation cannot be overstated. Throughout this article, we’ve exposed the lies and misdirections used to hide the truth from the American people. The Fed’s unchecked power to print money is the real culprit behind rising prices, not the scapegoats they trot out to fool you. The Fed has robbed Americans of their purchasing power and economic freedom by flooding the market with new dollars.

It’s time for Patriots to wake up and fight back against this financial manipulation. The erosion of our wealth and the destruction of our dollar must end. To wrap up, remember that we can only reclaim control of our economy by holding the Federal Reserve accountable and securing a stable financial future for generations. Stand up, America—expose the Fed’s inflation lies and demand change now!

FAQs

How does the Federal Reserve contribute to inflation?

The Federal Reserve influences inflation primarily by using its monetary policy tools to affect financial conditions, including the economy’s availability and cost of credit.

What are the current drivers of inflation?

Inflation has recently been driven by increased wage pressures as the labor market tightened during 2021 and 2022. This tightening is reflected in the rising ratio of job vacancies to unemployment, leading firms to raise prices as workers demand higher wages.

Does inflation reduce the value of money?

Yes, inflation diminishes the purchasing power of money. For example, something that cost USD 1.00 in the 1920s would cost about USD 18.00 today due to inflation. This means that each currency unit buys less than it did in the past, effectively reducing the value of money over time.

Who gains from inflation?

Inflation can benefit borrowers by allowing them to repay their debts with money that is worth less than when it was initially borrowed. Additionally, as inflation drives up prices, the demand for credit increases, leading to higher interest rates benefiting lenders [21].

References

[1] – http://online.wsj.com/article/SB10001424052748703730804576319173360183278.html

[2] – https://www.britannica.com/money/inflation-economics

[3] – https://www.npr.org/2022/11/29/1139342874/corporate-greed-and-the-inflation-mystery

[5] – https://www.pbs.org/newshour/economy/analysis-why-any-party-in-power-cant-do-much-about-inflation

[6] – https://www.aier.org/article/fact-checking-greedflation/

[7] – https://www.cato.org/publications/commentary/how-federal-reserve-literally-makes-money

[8] – https://www.federalreserve.gov/faqs/money_12856.htm

[9] – https://www.federalreserve.gov/monetarypolicy/files/balance_sheet_developments_report_202111.pdf

[10] – https://www.investopedia.com/ask/answers/06/oilpricesinflation.asp

[11] – https://www.investopedia.com/terms/f/fractionalreservebanking.asp

[12] – https://www.federalreservehistory.org/essays/great-inflation

[14] – https://www.brookings.edu/articles/fed-response-to-covid19/

[15] – https://www.investopedia.com/articles/insights/122016/9-common-effects-inflation.asp

[17] – https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

[18] – https://medium.com/@AnCapSTK88/the-truth-about-the-federal-reserve-af64be13d369

[19] – Κάμπας, Γ. (2018). Οι αγορές πετρελαίου και εμπορευμάτων στη ναυτιλία – ανάλυση του διεθνούς εμπορίου και ο αντίκτυπος που έχουν οι τιμές του πετρελαίου στο θαλάσσιο μεταφορικό κόστος. http://dione.lib.unipi.gr/xmlui/handle/unipi/11572?show=full

[20] – AFGE | Rising COLA Falls a Little Flat. https://www.afge.org/article/rising-cola-falls-a-little-flat/

[21] – What are current personal loan rates? | Fox Business. https://www.foxbusiness.com/personal-finance/personal-loan-rates-are-low

[22] – https://www.infowars.com/posts/only-the-federal-reserve-can-cause-inflation/

[23] – https://mises.org/mises-wire/feds-fiat-money-real-cause-price-inflation

[24] – https://www.bls.gov/cpi/

[25] – https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

[26] – https://fred.stlouisfed.org/series/BOGMBASE/

Leave a comment